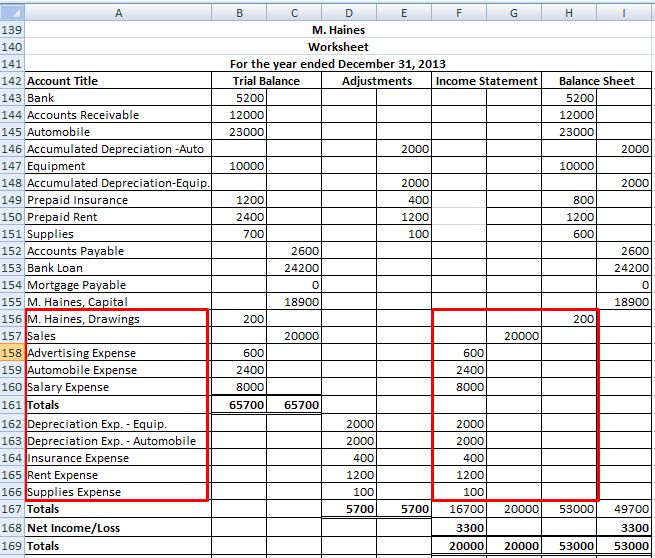

By leveraging automated systems, businesses can ensure that all tasks related to closing entries are handled seamlessly, reducing manual effort and minimizing errors. Once we have made the adjusting entries for the entire accounting year, we have obtained the adjusted trial balance, which reflects an accurate and fair view of the bakery’s financial position. The trial balance is like a snapshot of your business’s financial health at a specific moment. It lists the current balances in all your general ledger accounts.

Temporary and Permanent Accounts

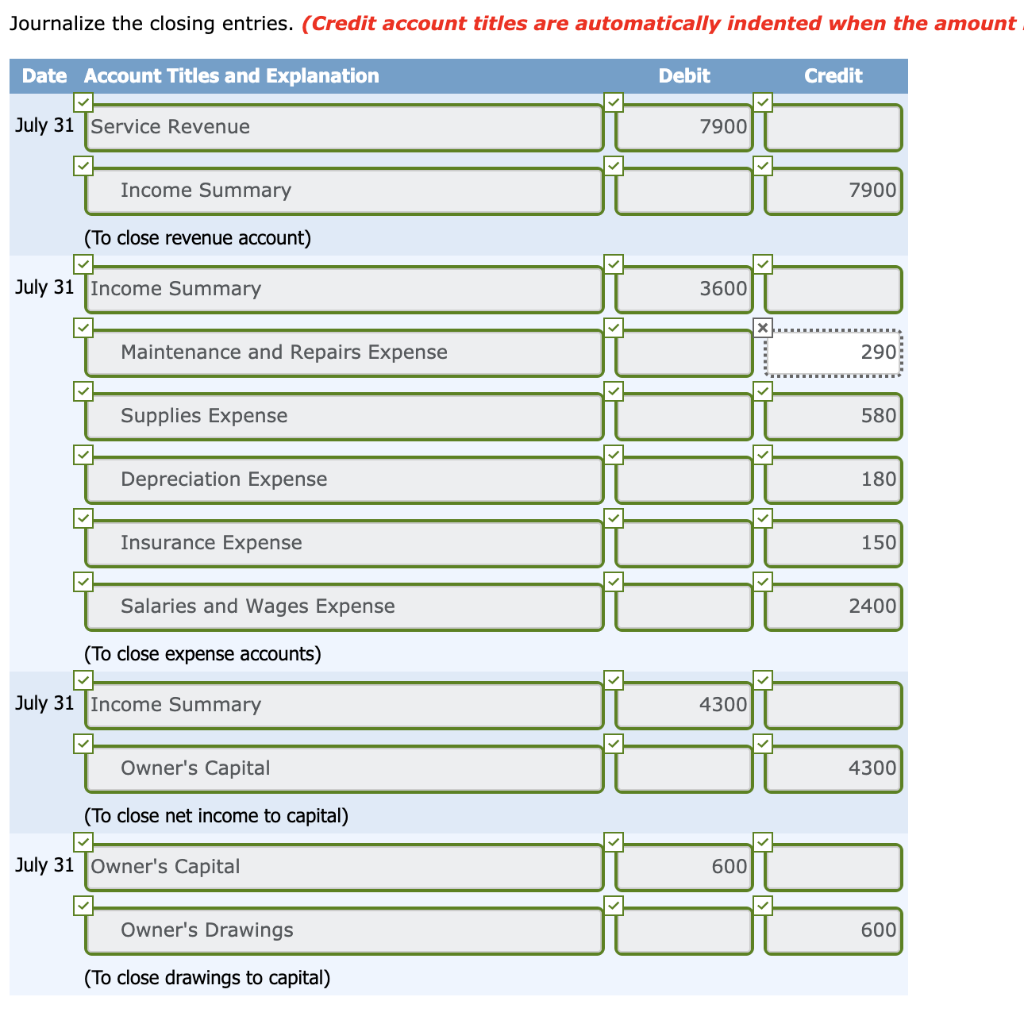

In a sole proprietorship, a drawing account is maintained to record all withdrawals made by the owner. In a partnership, a drawing account is maintained for each partner. All drawing accounts are closed to the respective capital accounts at the end of the accounting period. The $10,000 of revenue generated through the accounting period will be shifted to the income summary account.

- The term can also mean whatever they receive in their paycheck after taxes have been withheld.

- Remember the income statement is like a moving picture of a business, reporting revenues and expenses for a period of time (usually a year).

- All expenses can be closed out by crediting the expense accounts and debiting the income summary.

- Adjusting entries ensures that revenues and expenses are appropriately recognized in the correct accounting period.

What are the transactions made at the end of an accounting period?

As well as being consistently up-to-date on the financial health of your business. We have completed the first two columns and now we have the final column which represents the closing (or archive) process. The T-account summary for Printing Plus after xero partner programare journalized is presented in Figure 5.7.

What do closing entries include?

Both closing and opening entries record transactions, but there is a slight variation in their purpose. On the statement of retained earnings, we reported the ending balance of retained earnings to be $15,190. We need to do the closing entries to make them match and zero out the temporary accounts. If dividends were not declared, closing entries would cease atthis point. If dividends are declared, to get a zero balance in theDividends account, the entry will show a credit to Dividends and adebit to Retained Earnings. As you will learn in Corporation Accounting, there are three components to thedeclaration and payment of dividends.

In summary, the accountant resets thetemporary accounts to zero by transferring the balances topermanent accounts. Closing entries are posted in the general ledger by transferring all revenue and expense account balances to the income summary account. Then, transfer the balance of the income summary account to the retained earnings account. Finally, transfer any dividends to the retained earnings account.

Step 1: Clear revenue to the income summary account

Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period. From this trial balance, as we learned in the prior section, you make your financial statements. After the financial statements are finalized and you are 100 percent sure that all the adjustments are posted and everything is in balance, you create and post the closing entries. The closing entries are the last journal entries that get posted to the ledger.

Closing entries take place at the end of an accounting cycle as a set of journal entries. The closing entries serve to transfer these temporary account balances to permanent entries on the company’s balance sheet. This resets the balance of the temporary accounts to zero, ready to begin the next accounting period. The balance in dividends, revenues and expenses would all be zero leaving only the permanent accounts for a post closing trial balance. The trial balance shows the ending balances of all asset, liability and equity accounts remaining.

The first part is the date ofdeclaration, which creates the obligation or liability to pay thedividend. The second part is the date of record that determines whoreceives the dividends, and the third part is the date of payment,which is the date that payments are made. Printing Plus has $100 ofdividends with a debit balance on the adjusted trial balance. Theclosing entry will credit Dividends and debit RetainedEarnings.

The purpose of the closing entry is to reset temporary account balances to zero on the general ledger, the record-keeping system for a company’s financial data. The end result is equally accurate, with temporary accounts closed to the retained earnings account for presentation in the company’s balance sheet. We see from the adjusted trial balance that our revenue account has a credit balance. To make the balance zero, debit the revenue account and credit the Income Summary account. Other accounting software, such as Oracle’s PeopleSoft™, post closing entries to a special accounting period that keeps them separate from all of the other entries. So, even though the process today is slightly (or completely) different than it was in the days of manual paper systems, the basic process is still important to understand.