- What your need to know about buying a foreclosed home

- Just how do home foreclosures works?

- Types of foreclosure

- Investment an effective foreclosed family

- Cons of buying a foreclosed home

- Extended procedure with increased paperwork

- Domestic standing issues

- Competition

- Pros of buying a foreclosed home

- Price pricing

- Financial support opportunities

- Make smart a residential property investments together with Belong

You’ll find foreclosed belongings into the virtually every market in the country, and buying good foreclosed home is convenient following middle-2000s home loan crisis. Adopting the moratorium into the foreclosure, as a result on COVID-19 pandemic, finished from inside the , dealers asked an increase in foreclosures. Yet not, the audience is nevertheless seeing a small also have and you may significant battle. Ideal added bonus when you look at the to get a good foreclosed home is will cost you, however, unpredictable timelines, solutions, and you will stiff competition will get deter you against buying an excellent foreclosed household.

There are lots of version of foreclosures: pre-foreclosures, brief revenue, sheriff’s income, bank-owned, and bodies-possessed. Most of the particular foreclosures enjoys novel services, and get techniques varies. Consider opting for a representative who’s used to the fresh new property foreclosure techniques. They are capable give you certain understanding considering the knowledge.

Just how can property foreclosures really works?

Whenever an owner can’t make repayments to their home loan, the lending company requires hands of the home. The financial institution usually delivers a notice away from default immediately following 90 days away from missed repayments. Have a tendency to, the fresh resident has got the opportunity to plan for yet another percentage plan into the financial before the home is marketed. If you are to buy a beneficial foreclosed home, youre getting the domestic regarding bank, maybe not the brand new home’s brand-new owner.

Version of foreclosures

Pre-foreclosure: Given that proprietor is actually standard on the mortgage, he’s notified https://cashadvanceamerica.net/ of the lender. In the event the citizen are selling the house or property during the pre-property foreclosure several months, capable avoid the foreclosure processes and lots of of affects on the credit history.

Short transformation: If the a resident are long lasting pecuniary hardship, they are able to to market their house into the an initial selling. The lender has to agree to undertake less on the property than what the fresh new resident already owes on the home loan. Small conversion process are going to be very long since financial must function and approve the deal.

Sheriff’s purchases: Sheriff’s conversion process was auctions held immediately after homeowners default on the money. This type of auctions is facilitated of the local the authorities, and therefore title sheriff’s sales. On these deals, the home is available for the highest buyer.

Bank-possessed features: If property doesn’t offer within market, it becomes a genuine estate holder (REO) assets. The loan lender, financial, otherwise financial trader is the owner of the house or property, that particular services are now and again also known as bank-owned residential property.

Government-owned functions: The same as REO features, these domestic was initially ordered using an enthusiastic FHA otherwise Va mortgage, one another regulators-back money. Whenever this type of characteristics was foreclosed and do not promote from the public auction, they become regulators-owner services. Then, he is sold by agents who work on the part of the newest institution hence provided the loan.

Investment an excellent foreclosed household

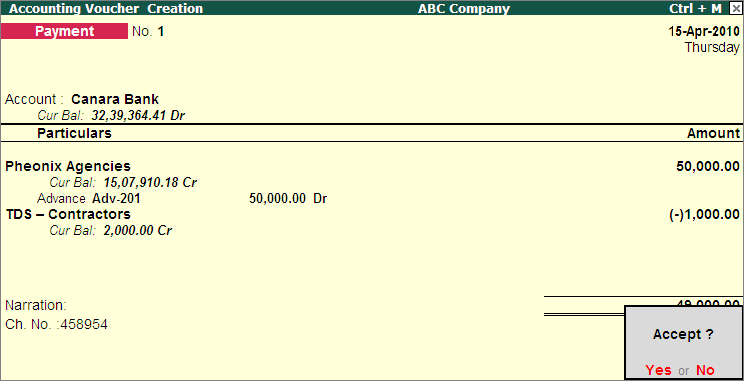

When you’re every cash offers deliver your greatest advantage whenever to purchase an effective foreclosed home, some financing choices are available for financial support properties. Understand that personal loan providers may be less likely to want to loans the purchase out-of an excellent foreclosed domestic. So you can facilitate the method, think opting for a lender and receiving pre-acknowledged having a mortgage loan.

When you’re trying to find purchasing a foreclosure, we advice examining the bodies-paid resource options available to those which meet the requirements. A good 203(k) financing is a type of investment provided by the new Government Housing Administration (FHA). You will find several different types of 203(k) money. You can easily basically getting charged home financing advanced in order to counterbalance the bank’s chance. Additionally get the rates of interest of these sorts of fund are about 0.25% more than old-fashioned fund.